If you have a high net worth, complex estate or tax situation, or just want someone to answer your financial questions Harvest Asset Group, you may want to work with a financial advisor.

However, advisor fees can be expensive, and some people wonder if it’s worth the investment. The question of whether higher costs result in better results depends on the type of work you’re hiring them for and the nature of their services.

1. Fee-based

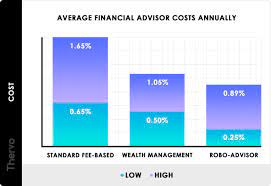

Financial advisors typically charge fees based on a percentage of assets under management (AUM) and sometimes have breakpoints or AUM fee tiers for different asset amounts. If you have a large portfolio, this can be expensive and limiting, so it’s important to find an advisor with a low AUM fee or who offers a household discount for multiple investors.

The typical advisory fee charged by financial advisors is 1% of AUM, but that’s just the tip of the iceberg. Those costs include a combination of financial planning, investment management, products, and platform fees. And while some advisors “wrap” those costs into a single 3% AUM fee, that approach is not ideal for many clients with large portfolios.

2. Fee-only

A fee-only financial advisor earns money solely from the fees that their clients pay for their services. These can be hourly, flat, commissions or as a percentage of assets (AUM).

Some fee-only advisers also charge performance fees based on portfolio returns. This can encourage them to pursue riskier investment strategies than those that are best for their clients’ financial circumstances.

Most fee-only financial advisors are fiduciaries, which means they put their clients’ interests first and foremost. However, they may still be influenced by incentives such as commissions and other fees to recommend products and strategies that don’t fully serve their client’s needs.

3. Flat fee

There are a number of different fee structures that financial advisors can use to charge for their services. Many will charge a percentage of assets under management (AUM) or a fixed rate based on your net worth or income.

The percentage based model is a good fit for wealth managers who have a narrow client base and need to limit their fees. It is not suitable for those who are bringing on new clients with vastly differing needs.

Commissions are another popular way that financial advisors earn their fees. These commissions are usually earned on products that you invest in, such as mutual funds or annuities.

These commissions can amount to a significant portion of the fees you pay for investment advice. They can also be a hidden cost that affects your investment returns.

4. Hourly rate

Financial advisors can charge a variety of fees, including an hourly rate, a flat fee, and a percentage of assets under management (AUM). It is important to understand all of these fees, so you know what you are paying for.

For example, if you are looking for one-off financial planning, an hourly rate may be a good option. However, if you are looking for ongoing financial guidance and investment management, it may be more cost-effective to hire an advisor who charges a flat fee or a percentage of your assets under management.

According to our research, the fee that clients pay for a financial plan is significantly related to plan preparation time. This is largely due to the fact that financial planners spend a large amount of time using more comprehensive financial planning software to produce more in-depth plans.

5. Commissions

Commission-based financial advisors earn their income by selling products or investments on your behalf and receiving payment in a percentage of the sale price each time. Many clients don’t realize that advisors working for major firms are more like independent contractors than employees, and their compensation is usually based on commissions, not base salary.

Conclusion

As a result, a commission-based Financial Advisors Portland ME financial advisor may recommend products or services that they’re motivated to sell, but don’t necessarily have the client’s best interests at heart. This can create a conflict of interest, and it’s also important to consider how the client’s financial goals and objectives fit in with a commission-based advisor’s incentives.

More Stories

Versatile Universal Load Cell for Aircraft Weighing – MODEL: UNV, UNV-C

Why Hiring A Content Writer For Your Website Is A Smart Concept

Brazilian Hardwood Decking: The Ultimate Outdoor Solution