You can diversify your investments in a variety of assets such as stocks, bonds, real estate, gold, etc through mutual funds.

Mutual funds are categorized based on the asset they majorly invest in. For example, equity mutual funds invest majorly in stocks, whereas debt funds invest in bonds, similarly REITS funds invest in real estate and gold funds in gold.

Among all the different types of assets that mutual funds invest in, the ones that majorly invest in stocks and bonds are two most popular types of mutual fund investment in India. Hence, we can broadly say that equity and debt mutual funds generate the highest mutual fund returns.

To narrow down on the selection of mutual fund investments in India, you must first decide on your purpose of investment, risk appetite and time period for investment.

Purpose of investment –

The variety of assets that you can invest in through mutual funds has different risk to reward ratios. And helps in achieving several financial goals such as tax savings, long-term wealth creation, periodic income post retirement, creating emergency funds for short term liquidity, etc.

Risk appetite –

Risk appetite of an individual is determined by capability to take risk and willingness to take risk.

Time Period for investment –

While you invest in goals the time period is determined as to when the goal would mature, this becomes the time period for investments.

Individuals who invest randomly in different assets without a financial goal often make losses as they simply lose patience. When their investments start making losses in the short run or might liquidate the asset too soon due to the liquidity crisis.

Determining best mutual fund investments in India for 2022:

Most financial experts recommend that if you are looking to invest in assets that are less risky. And offer fixed or regular returns, the debt mutual funds would be best for you. On the other hand, if you are looking to invest in assets that are high risk but have the potential to give higher returns, equity mutual funds may suit you.

Although, the risk of losing capital is present in both debt as well as equity mutual fund investments. The equity mutual funds are consider to have a comparatively higher risk due to the volatility in stock market. However, if we study macroeconomics, one can easily see that equity mutual funds are simply the best mutual fund investments in India.

Below are few macroeconomic factors that show why equity mutual funds are the best mutual fund investments in India:

- Economic growth in the country due to factors like cheap labour, favourable Government policy, easy credit, large market to sell, etc. Helps companies to prosper which leads to appreciation in stock prices over the time. India is one of the fastest growing large economies of the world. Hence the Indian equities are an attractive investment option.

- In order to support economic growth, companies may have to borrow money for expansion. When interest rates are high, companies are not motivate to borrow and this affects the economic growth. Interest rates in India have come down significantly over the years. Which not only makes borrowing cheap for companies to grow but also gives rise to higher inflation.

- In rising inflation and reducing interest rate economies, investing your money in debt assets such as bonds, FDs, RDs, etc. And will fail to give you a growth in returns and at times returns are even below inflation rate. While, investments in equities provide an opportunity to earn better returns in such economies.

- Government and Central bank use several techniques to control inflation. In case the inflation rate goes up beyond a threshold limit, one such technique is to increase the interest rate. However, such measures are only for short to medium-term. As interest rates cannot be kept high for a prolong period, doing that may impact the growth of the country. Moreover, limited availability of resources will push inflation high which in a high interest economy may lead to a recession. Hence, you would see that interest rates on debt instruments will be regularly going down in a certain time span but equities shall be performing better.

Hence, equity mutual funds are the best mutual fund investment in India. Even based on the past performance, you will see that equity mutual funds have outperformed all other funds in India mainly due to the economic growth within the country.

Investing in equity mutual funds can be done through SIPs (Systematic Investment Plan), Lump Sum, STP (Systematic Transfer Plan) or SWP (Systematic Withdrawal Plan). You can select any of the investing styles based on your financial goal.

For example:

Wealth creation – It is a long-term goal and so it would be best to make mutual fund investments through SIP. As you can avail the benefit of rupee cost averaging on the units you get.

Nearing Retirement – You may start mutual fund investments through STP. Which ensure that the asset allocation from equities is reduce on a regular time interval. And is adjust to bonds and other debt instruments, ensuring reduction in risk at regular time intervals.

On Retirement – You may opt for mutual fund investments through SWP. Which would provide a regular withdrawal and a constant cash flow to manage daily expenditures.

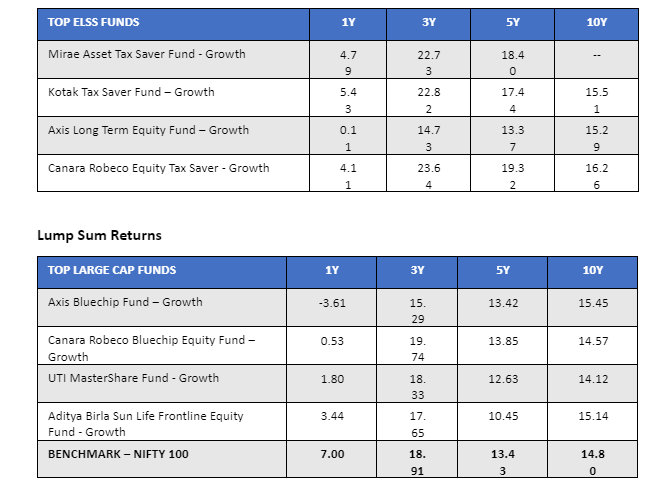

Lump Sum – You may choose a Lump Sum investment on a large inflow like inheritance, yearly bonus from employee, etc.

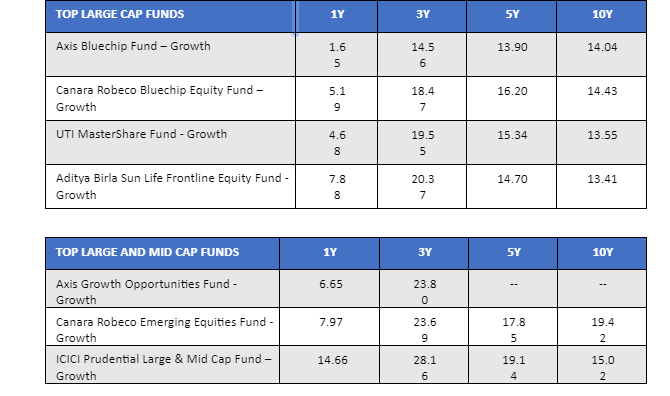

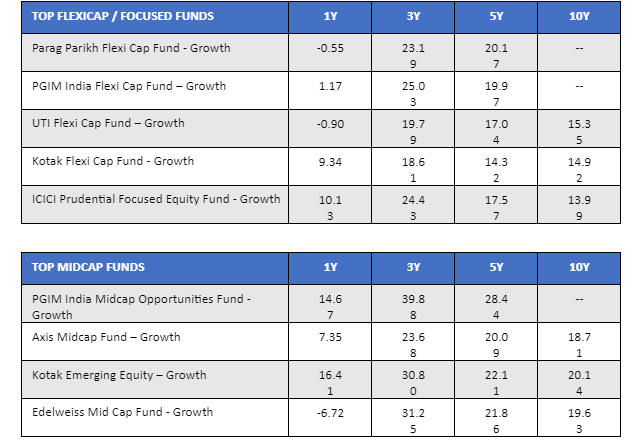

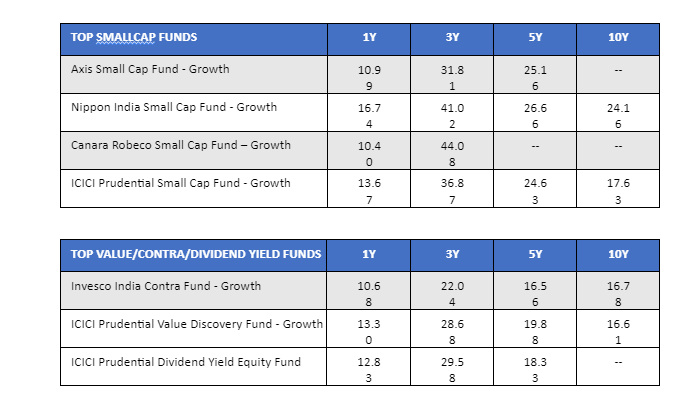

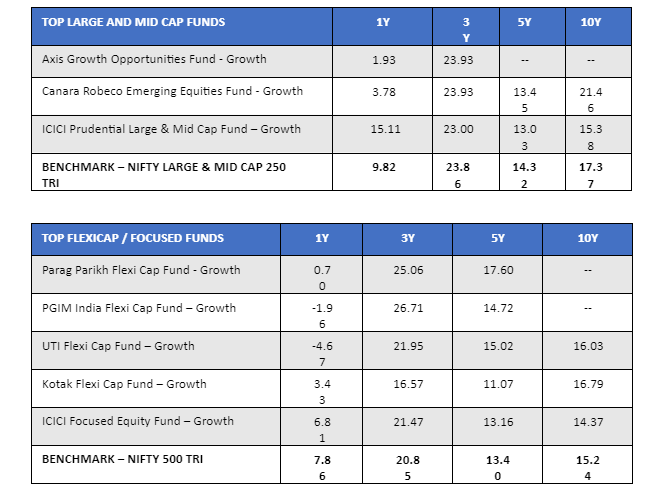

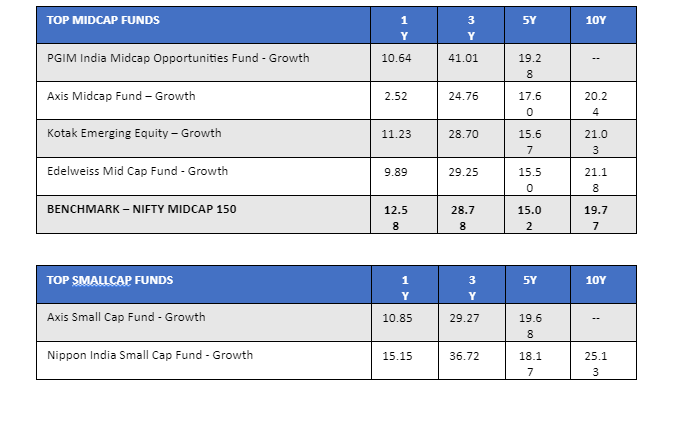

Below are few best mutual funds investments in India for 2022:

SIP Returns:

More Stories

Versatile Universal Load Cell for Aircraft Weighing – MODEL: UNV, UNV-C

Why Hiring A Content Writer For Your Website Is A Smart Concept

Brazilian Hardwood Decking: The Ultimate Outdoor Solution